Thursday, April 13, 2017

Monday, April 10, 2017

April 3, 2017

Loanable Funds Market

The Loanable Funds Market

- An interest rate of 50%

- BAD for BORROWERS

- GOOD for SELLERS

- The loanable funds market is the private sector supply and demand of loans

- Brings together those that want to lend money (savers) and those who want to borrow (firms with investment spending projects)

Shows the Effect on Real Interest Rate

- Demand: Inverse relationship between real interest rate and quantity loans demanded

- Supply: Direct relationship between real interest rate and quantity loans supplied

- NOT the same as the money market

- Supply is not vertical

Prime Rate

- The interest rate that banks charge their most credit worth customers

- BAD for BORROWERS

- GOOD for SELLERS

- Brings together those that want to lend money (savers) and those who want to borrow (firms with investment spending projects)

- Demand: Inverse relationship between real interest rate and quantity loans demanded

- Supply: Direct relationship between real interest rate and quantity loans supplied

- NOT the same as the money market

- Supply is not vertical

Prime Rate

- The interest rate that banks charge their most credit worth customers

March 31, 2017

3 Tools of Monetary Policy

3 Tools of Monetary Policy

- Reserve Requirement

- Open Market Operations (OMO)

- Discount Rate

Reserve Requirement

- The FED sets the amount that banks must hold

- Bank deposits when someone (public or private) deposits money in the bank

- Banks keep some of the money in reserves and loans out their excess reserves

- The loan eventually becomes despots for another bank that will loan out their excess reserves

- The reserve requirement (reserve ratio) is the percent of deposits that the bank cannot loan out

- If there is a recession, the bank should:

- Decrease RR

- Banks hold less money and have more excess reserves

- Banks create more money by loaning out excess

- Money supply increases, Interest Rates Fall, Aggregate Demand Increases

- If there is an inflation, the bank should

- Increase RR

- Banks hold more money and have less ER

- Banks create less money

- Money Supply decreases, Interest Rates increase, Aggregate Demand decreases

Open Market Operations

- When the FED buys or sells government bonds (securities)

- Most important/widely used monetary policy

- If the FED buys bonds ---> takes bonds out of economy and replaces them with money

If the bank buys bonds, the money supply increases

If the bank sells bonds, the money supply decreases

- Effect is enhanced by multiplier, but if banks don't loan it out or people store it, it becomes effective.

The Discount Rate

- The interest rate that the FED charges commercial banks for short term loans

The Federal Fund Rate

- The interest rate that banks charge one another for overnight loans

- Reserve Requirement

- Open Market Operations (OMO)

- Discount Rate

Reserve Requirement

- The FED sets the amount that banks must hold

- Bank deposits when someone (public or private) deposits money in the bank

- Banks keep some of the money in reserves and loans out their excess reserves

- The loan eventually becomes despots for another bank that will loan out their excess reserves

- The reserve requirement (reserve ratio) is the percent of deposits that the bank cannot loan out

- If there is a recession, the bank should:

- Decrease RR

- Banks hold less money and have more excess reserves

- Banks create more money by loaning out excess

- Money supply increases, Interest Rates Fall, Aggregate Demand Increases

- If there is an inflation, the bank should

- Increase RR

- Banks hold more money and have less ER

- Banks create less money

- Money Supply decreases, Interest Rates increase, Aggregate Demand decreases

Open Market Operations

- When the FED buys or sells government bonds (securities)

- Most important/widely used monetary policy

- If the FED buys bonds ---> takes bonds out of economy and replaces them with money

If the bank buys bonds, the money supply increases

If the bank sells bonds, the money supply decreases

- Effect is enhanced by multiplier, but if banks don't loan it out or people store it, it becomes effective.

The Discount Rate

- The interest rate that the FED charges commercial banks for short term loans

The Federal Fund Rate

- The interest rate that banks charge one another for overnight loans

Sunday, April 9, 2017

March 24, 2017

Money Creation Formula

- A single bank can create $ by the amount of its excess reserves

- The banking system as a whole can create $ by a multiple of the excess reserves

*MM x ER = Expansion of Money

*Money Multiplier = 1/RR

New vs. Existing $

- If the initial deposit in a bank comes from the Fed, or bank purchase of a bond or other money out of circulation (buried treasure), the deposit immediately increases money supply

- The deposit then leads to further expansion of the money supply through the money creation process

*Total change in MS if initial deposit is new $ = Deposit + $ created by banking system

- If a deposit in a bank is existing $ (already counted in M1; ex: currency or checks), depositing the amount does not change the MS immediately because it is already counted.

- Existing currency deposited into checking account changes only the composition of the money supply from coins/paper $ to checking account deposits

*Total Change in the MS if deposit is existing $ = Banking System Created Money Only

- If the initial deposit in a bank comes from the Fed, or bank purchase of a bond or other money out of circulation (buried treasure), the deposit immediately increases money supply

- The deposit then leads to further expansion of the money supply through the money creation process

*Total change in MS if initial deposit is new $ = Deposit + $ created by banking system

- If a deposit in a bank is existing $ (already counted in M1; ex: currency or checks), depositing the amount does not change the MS immediately because it is already counted.

- Existing currency deposited into checking account changes only the composition of the money supply from coins/paper $ to checking account deposits

*Total Change in the MS if deposit is existing $ = Banking System Created Money Only

March 23, 2017

- Demand Deposits

- Created through the Fractional Reserve System

- Fractional Reserve System

- The process in which banks hold a small portion of their deposits in reserves and they loan out the excess.

- Required Reserves

- Cash that banks keep on hand

- Total Reserves (TR) or Actual Reserves (AR)

- Created through the Fractional Reserve System

- The process in which banks hold a small portion of their deposits in reserves and they loan out the excess.

- Cash that banks keep on hand

March 22, 2017

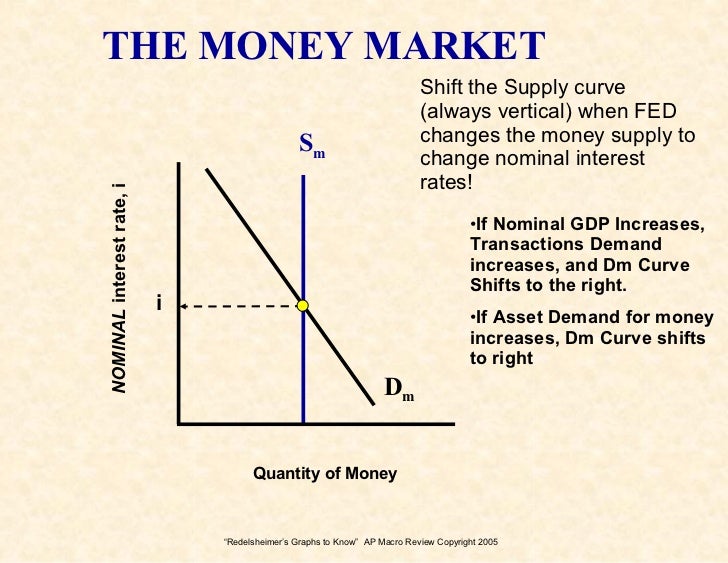

The Money Market

- Demand for money has an inverse relationship between nominal interest rates and the quantity of money demanded (vise versa):

- When interest rates rise, the quantity demanded of money falls because individuals would prefer to have interest earning assets instead of borrowed liabilities.

- When interest rates fall, quantity demanded increases. No incentive to convert cash into interest earning assets.

Money Demand Shifters

- When interest rates rise, the quantity demanded of money falls because individuals would prefer to have interest earning assets instead of borrowed liabilities.

- When interest rates fall, quantity demanded increases. No incentive to convert cash into interest earning assets.

March 22, 2017

Stocks and Bonds

Stocks:

- You Own

Bonds: Loans, or IOU's, that represent debt that the government or a corporation must repay to an investor

- You Loan

- Bond holder has no ownership of the company

- If a corporation issues and then sells a bond:

- Liability for corporation

- Asset for the buyer

- If that corporation issues a 10k bond with a 10 year term and a 5% interest:

- Nominal Interest Rate @ time of issue: 5%

- Nominal Interest Rate falls to 3% bond increases

- Nominal Interest Rate rises to 8% bond decreases

Stockowners can earn a profit in 2 ways:

- Dividends: Portions of a corporation's profits; paid out to stockholders

- Higher corporate profit, the higher the dividend

- Capital Gain: Earned when a stockholder sells stock for more than he or she paid for it.

- A stockholder that sells stock at a lower price then the purchase price suffers capital loss.

Federal Reserve System:

- "The FED" or "Central Bank"

- Stabilize the economy and maximum employment

- You Loan

- Bond holder has no ownership of the company

- If a corporation issues and then sells a bond:

- Liability for corporation

- Asset for the buyer

- If that corporation issues a 10k bond with a 10 year term and a 5% interest:

- Nominal Interest Rate @ time of issue: 5%

- Nominal Interest Rate falls to 3% bond increases

- Nominal Interest Rate rises to 8% bond decreases

Stockowners can earn a profit in 2 ways:

- Dividends: Portions of a corporation's profits; paid out to stockholders

- Higher corporate profit, the higher the dividend

- Capital Gain: Earned when a stockholder sells stock for more than he or she paid for it.

- A stockholder that sells stock at a lower price then the purchase price suffers capital loss.

Federal Reserve System:

- "The FED" or "Central Bank"

- Stabilize the economy and maximum employment

Subscribe to:

Comments (Atom)