March 22, 2017

The Money Market

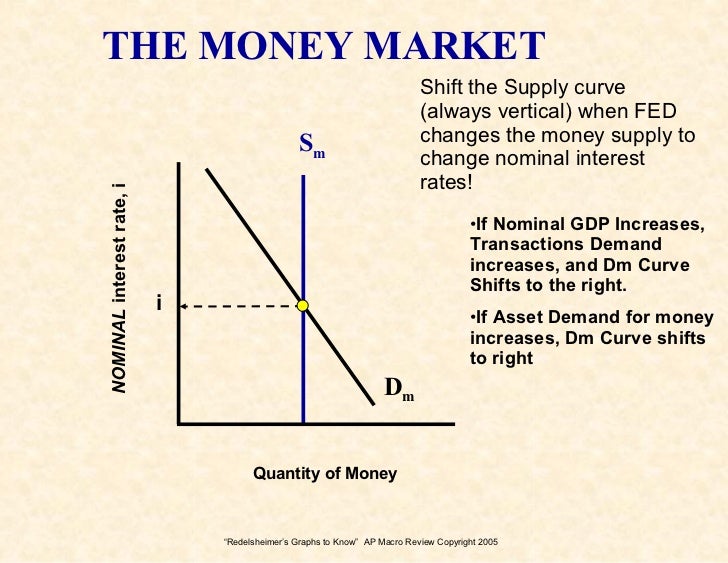

- Demand for money has an inverse relationship between nominal interest rates and the quantity of money demanded (vise versa):

- When interest rates rise, the quantity demanded of money falls because individuals would prefer to have interest earning assets instead of borrowed liabilities.

- When interest rates fall, quantity demanded increases. No incentive to convert cash into interest earning assets.

Money Demand Shifters

- Change in the Price Level

- Change in Income

- Change in Taxation that affects investment

No comments:

Post a Comment